India's Textile Industry Continues To Attract Investors

In the last quarter of 2018-19 (January-March), 47 Industrial Entrepreneurs' Memorandum (IEMs), related to textile and clothing investments, were filed with the Department of Industrial Policy & Promotion (DIPP), compared to 60 IEMs filed during January-March 2017-18 fiscal year.

Interest in yarn manufacturing remains high

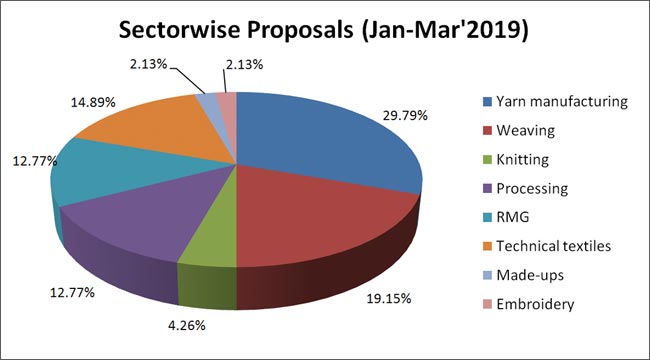

newsSectorwise, the yarn manufacturing sector (including spun and filament) received 14 proposals (14 in 2018 too), weaving received nine proposals (14 in 2018), knitting two (2 in 2018), processing six (9 in 2018), RMG six (8 in 2018), technical textiles seven (8 in 2018), made-ups one (3 in 2018).

Investors have shown interest in adding around 83060 metric tons of yarn manufacturing capacity, according to the IEMs filed.

Around 46.25 million metres of weaving capacity will be added. Around 52 million metres of processing capacity will get added. And around 33.61 million pieces of apparel will be added, as per the IEMs filed during January-March 2019.

Gujarat continues to attract textile investors

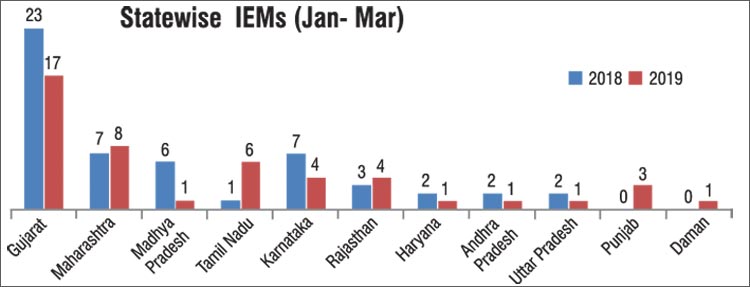

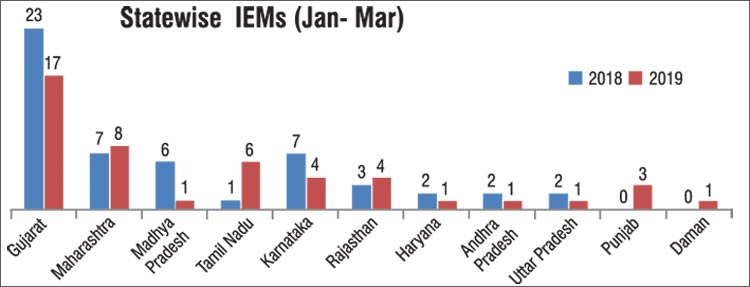

Statewise, as always, Gujarat leads in attracting investments. As per the IEMs, 17 out of the 47 proposals, or 36% of the proposals are for investments in Gujarat. During January-March 2018, IEMs for Gujarat stood at 23.

Maharashtra was the second most preferred investment destination with eight proposals during the 2019 quarter, compared to seven proposals during the 2018 quarter.

Tamil Nadu received six IEM proposals during January-March 2019, compared to just one proposal during January-March 2018.

newsSectorwise, the yarn manufacturing sector (including spun and filament) received 14 proposals (14 in 2018 too), weaving received nine proposals (14 in 2018), knitting two (2 in 2018), processing six (9 in 2018), RMG six (8 in 2018), technical textiles seven (8 in 2018), made-ups one (3 in 2018).

Investors have shown interest in adding around 83060 metric tons of yarn manufacturing capacity, according to the IEMs filed.

Around 46.25 million metres of weaving capacity will be added. Around 52 million metres of processing capacity will get added. And around 33.61 million pieces of apparel will be added, as per the IEMs filed during January-March 2019.

Gujarat continues to attract textile investors

Statewise, as always, Gujarat leads in attracting investments. As per the IEMs, 17 out of the 47 proposals, or 36% of the proposals are for investments in Gujarat. During January-March 2018, IEMs for Gujarat stood at 23.

Maharashtra was the second most preferred investment destination with eight proposals during the 2019 quarter, compared to seven proposals during the 2018 quarter.

Tamil Nadu received six IEM proposals during January-March 2019, compared to just one proposal during January-March 2018.

Madhya Pradesh during the 2019 quarter received just one IEM proposal, compared to six in the same quarter of 2018.

Karnataka is another favoured investment destination, with proposals for four projects during the 2019 period, compared to seven proposals during January-March 2018.

Rajasthan received four proposals in the 2019 quarter (3), Punjab 3 (0 in 2018), Haryana 1 (2), Andhra Pradesh 1 (2), Uttar Pradesh 1 (2).

Some leading investors who filed IEMs

Some leading investors in the yarn manufacturing sector include Mercury Management & Technical Services of Karnataka, Sri Ramco Spinners from Tamil Nadu, Ginza Industries, Maharashtra, Arihant Spintex, Punjab, among others.

In weaving, some of the investors include D'Décor, Maharashtra, Shiv Shakti, Gujarat, Sri Vishnu Weaving, Tamil Nadu.

In knit fabrics, IEMs were submitted among others by Ginza Industries, Maharashtra, Nagpur Spintex, Maharashtra.

In processing, some of the IEMs are from Kalyanpur Textiles, Karnataka, Sarvodaya India, Rajasthan, Viraj Fabrics, Gujarat. RMG IEMs are from companies such as Laguna Clothing, Karnataka, AHP Apparel from Delhi, SP Apparels, Tamil Nadu.

In technical textiles, Vortex Flex from Gujarat filed an IEM for manufacturing of PVC coated fabrics. A-One Tex Tech from Delhi plans to set up manufacturing facility for PP spunbond nonwoven fabrics. Novatis Hygiene from Maharashtra will set up production facility for baby diapers.

Shakti Polyweave from Gujarat plans to manufacture PP woven fabrics and other technical textiles, Swan Medicot, also from Gujarat is planning to manufacture absorbent cotton, cotton plaster, and other medical textiles.

Flipkart relocates manufacturing, sourcing to India

Meanwhile, in another development that highlights India as an attractive manufacturing and sourcing destination, Walmart-owned Flipkart has reportedly relocated a significant portion of manufacturing and sourcing for its in-house brands to India.

The homegrown e-commerce major was sourcing products for its brands from China and Malaysia. This move has helped Flipkart to reduce costs and comply with the government's Make in India norms.

Flipkart's private brands include MarQ, Perfect Homes, Billion and Smart-Buy. These brands account for 8% of the company's total sales. According to Flipkart officials, out of 150 factories Flipkart works with, 100 are in India.

Amazon, leading e-commerce player also has most of the manufacturing for its private labels in India.

Madhya Pradesh during the 2019 quarter received just one IEM proposal, compared to six in the same quarter of 2018.

Karnataka is another favoured investment destination, with proposals for four projects during the 2019 period, compared to seven proposals during January-March 2018.

Rajasthan received four proposals in the 2019 quarter (3), Punjab 3 (0 in 2018), Haryana 1 (2), Andhra Pradesh 1 (2), Uttar Pradesh 1 (2).

Some leading investors who filed IEMs

Some leading investors in the yarn manufacturing sector include Mercury Management & Technical Services of Karnataka, Sri Ramco Spinners from Tamil Nadu, Ginza Industries, Maharashtra, Arihant Spintex, Punjab, among others.

In weaving, some of the investors include D'Décor, Maharashtra, Shiv Shakti, Gujarat, Sri Vishnu Weaving, Tamil Nadu.

In knit fabrics, IEMs were submitted among others by Ginza Industries, Maharashtra, Nagpur Spintex, Maharashtra.

In processing, some of the IEMs are from Kalyanpur Textiles, Karnataka, Sarvodaya India, Rajasthan, Viraj Fabrics, Gujarat. RMG IEMs are from companies such as Laguna Clothing, Karnataka, AHP Apparel from Delhi, SP Apparels, Tamil Nadu.

In technical textiles, Vortex Flex from Gujarat filed an IEM for manufacturing of PVC coated fabrics. A-One Tex Tech from Delhi plans to set up manufacturing facility for PP spunbond nonwoven fabrics. Novatis Hygiene from Maharashtra will set up production facility for baby diapers.

Shakti Polyweave from Gujarat plans to manufacture PP woven fabrics and other technical textiles, Swan Medicot, also from Gujarat is planning to manufacture absorbent cotton, cotton plaster, and other medical textiles.

Flipkart relocates manufacturing, sourcing to India

Meanwhile, in another development that highlights India as an attractive manufacturing and sourcing destination, Walmart-owned Flipkart has reportedly relocated a significant portion of manufacturing and sourcing for its in-house brands to India.

The homegrown e-commerce major was sourcing products for its brands from China and Malaysia. This move has helped Flipkart to reduce costs and comply with the government's Make in India norms.

Flipkart's private brands include MarQ, Perfect Homes, Billion and Smart-Buy. These brands account for 8% of the company's total sales. According to Flipkart officials, out of 150 factories Flipkart works with, 100 are in India.

Amazon, leading e-commerce player also has most of the manufacturing for its private labels in India.

Textile Excellence

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.