How Indian Textiles Turned Disruption Into Opportunity

As

the new year opens, India’s textile and apparel sector enters 2026 with rare

confidence. The past year was not just about turmoils of geopolitics and

tariffs, it was not just about schemes and statistics, 2025 marked a structural

shift. Infrastructure moved from plans to ground. Incentives translated into

production. Farmers, factories and fashion schools were all pulled into a

single forward-looking narrative: scale, speed and global relevance.

The

Ministry of Textiles’ 2025 year-end review reads less like a government

scorecard and more like a blueprint for the next decade. From mega textile

parks to fibre reforms, from GST rationalisation to export resilience, the

direction is clear - India wants to be a predictable, competitive and

future-ready textile powerhouse.

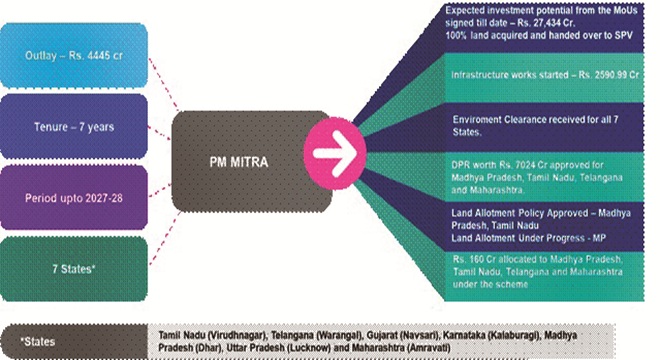

PM

MITRA: From vision to construction mode

The

PM Mega Integrated Textile Region and Apparel (PM MITRA) scheme crossed a

critical threshold in 2025 - execution.

Seven

parks across Tamil Nadu (Virudhnagar), Telangana (Warangal), Gujarat (Navsari),

Karnataka (Kalaburagi), Madhya Pradesh (Dhar), Uttar Pradesh (Lucknow) and

Maharashtra (Amravati) are now firmly on the map. With a total outlay of ₹4,445

crore up to 2027–28, these parks are designed as plug-and-play ecosystems,

integrating fibre, fabric, processing, garmenting and logistics.

Key

milestones achieved in 2025:

- 100% land acquisition completed and

handed over to SPVs

- Investment MoUs signed with an expected

investment potential of over ₹27,434 crore

- Infrastructure works worth ₹2,590.99

crore initiated by state governments

- Environmental clearances secured for

all seven parks

- DPRs worth ₹7,024 crore approved for

parks in Madhya Pradesh, Tamil Nadu, Telangana and Maharashtra

- Foundation stone laid at Dhar, Madhya

Pradesh

As

India enters 2026, PM MITRA parks are no longer policy promises, they are

emerging industrial cities that could redefine scale, cost efficiency and

global sourcing confidence.

Technical

Textiles: Quietly becoming a strategic engine

The

National Technical Textiles Mission (NTTM), with an outlay of ₹1,480 crore,

continued to build long-term capability rather than chase quick wins.

In

2025, the mission approved:

- 168 R&D projects worth ₹520 crore

across speciality fibres, composites, carbon fibre, aramid and machinery

- 24 startups, signalling growing private

innovation interest

- 45 proposals from IITs, NITs and

universities for new UG/PG programmes, backed by ₹204 crore for labs and

faculty training

- 8 Quality Control Orders covering 68

technical textile items

More

than half of PLI beneficiaries are now in technical textiles, underlining a

clear shift: this is no longer a niche segment but a capital-intensive,

high-value growth engine aligned with defence, infrastructure, healthcare and

sustainability.

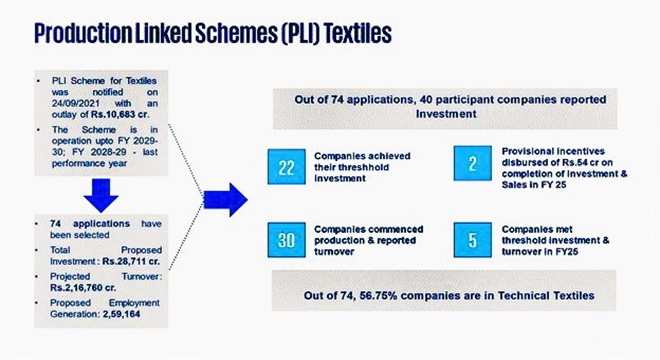

PLI

Textiles: Investment turning into output

The

Production Linked Incentive (PLI) scheme for textiles began delivering tangible

outcomes in 2025, moving beyond gestation.

Under

the scheme:

- 74 companies were selected

- Proposed investment: ₹28,711 crore

- Projected turnover: ₹2,16,760 crore

- Expected employment: 2,59,164 jobs

By

the end of 2025:

- 40 companies reported investments

- 22 achieved threshold investment levels

- 30 companies commenced production and

reported turnover

- ₹54 crore was disbursed as provisional

incentives to two companies

- Five companies met both investment and

turnover thresholds in FY 2024–25

With

56.75% of beneficiaries in technical textiles, the PLI scheme is quietly

reshaping India’s manufacturing profile from volume-driven to value-led.

Exports:

Stability in a volatile world

In

a year marked by geopolitical stress, tariffs and supply chain realignments,

India’s textile exports held firm.

Key

highlights:

- Textile and apparel exports reached US$

37.8 billion in 2024–25

- 5% year-on-year growth

- Trade surplus of US$ 28.2 billion

- India ranked as the world’s 6th largest

textile and apparel exporter

- The sector contributed 8.63% of India’s

total exports and 4.1% of global trade

Traditional

markets - the US, EU and UK - accounted for 55% of exports, while emerging

destinations such as Bangladesh, UAE, Sri Lanka, Australia and Canada

contributed 20%.

Looking

ahead, the Ministry’s Vision 2030 target of US$ 100 billion in exports signals

intent. The strategy is clear: market diversification, sustainability-led

differentiation and deeper district-level export mapping - already completed

across 520 districts.

SAMARTH:

Building the workforce of the future

Manufacturing

ambition means little without skilled hands. The SAMARTH scheme has emerged as

one of the quiet success stories of 2025.

So

far:

- 5.41 lakh people trained

- 4.76 lakh women beneficiaries (88%)

- 4.05 lakh candidates placed in jobs

(75%)

The

scheme blends modern, technology-enabled training with support for handlooms,

handicrafts and entrepreneurship. In FY 2025–26, SAMARTH targets skilling

another 2 lakh people, critical as PM MITRA parks and PLI units scale up.

Cotton:

Digitisation meets farmer security

Cotton

reforms in 2025 combined farmer protection with traceability and productivity.

During

the 2024–25 season:

- 525 lakh quintals (100 lakh bales)

procured under MSP

- ₹37,450 crore disbursed to farmers

- 38% of arrivals and 34% of national

production covered

Structural

reforms included:

- Launch of the Kapas Kisan app for

farmer registration and slot booking

- Blockchain-enabled QR-coded bales

(BITS) for traceability

- CotBiz platform for e-invoicing and

contract management

- Temporary customs duty exemption on raw

cotton imports (Aug–Dec 2025) to stabilise prices

The

newly announced 5-year Cotton Productivity Mission aligns farming with the

“Farm to Foreign” vision, while the Kasturi Cotton Bharat programme positions

Indian cotton as a branded, traceable global product.

Wool,

Silk and Jute: Strengthening traditional pillars

Wool

Under the Integrated Wool Development Programme (₹126 crore allocation), 2025

saw GI registration for Ladakh Pashmina, DNA testing facilities, R&D for

coarse wool, branding initiatives and common facility centres - modernising a

sector rooted in nomadic livelihoods.

Silk

India strengthened its global position as the second-largest silk producer. Raw

silk output rose to 41,121 MT, while bivoltine silk production surged nearly

300% since 2013–14. Digital tools like the SILKS portal, indigenous reeling

machines and price dissemination systems are making sericulture more efficient

and dignified.

Jute

Mandatory jute packaging norms continued to support 3.70 lakh workers and 40

lakh farmers. Lightweight jute bags, satellite-based crop assessment and

digitised procurement through PAAT-MITRO reflect how even legacy fibres are

being future-proofed.

GST

and regulatory reforms

One

of the most industry-impacting moves of 2025 was GST rationalisation:

- Man-made fibres and yarns reduced to 5%

GST

- Garments up to ₹2,500 per piece

retained at 5%

- Carpets, handicrafts, handlooms and

sewing machines moved to 5%

This

corrected inverted duty structures, freed working capital and aligned

fibre-to-fabric taxation.

Alongside,

decriminalisation under the Jan Vishwas framework reduced compliance anxiety

across silk, handloom and Textile Committee laws, signalling a shift to

trust-based governance.

Export-focused

relief in a tariff-heavy world

To

cushion the impact of US tariffs, the government extended:

- RoDTEP and RoSCTL schemes till March

2026

- Export obligation timelines from 6 to

18 months for QCO-linked products

- Import monitoring through MIP on

synthetic knitted fabrics

Crucially,

QCO-related relief on machinery, polyester and viscose staple fibre eased raw

material access and investment planning.

Bharat

Tex: Signalling global intent

Bharat

Tex 2025 was not just an exhibition, it was a statement.

Spread

over 2.2 million sqft, the event hosted:

- 5,000+ exhibitors

- 120,000 trade visitors

- Buyers from 120+ countries

- 70+ knowledge sessions

With

exports already touching ₹3 lakh crore, the ambition is clear: scale to ₹9 lakh

crore by 2030 by integrating fibre, fashion and foreign markets.

Looking

Ahead: A confident start to 2026

The

message from 2025 is unmistakable. India’s textile sector is no longer reacting

to global shifts, it is positioning itself to shape them.

Infrastructure

is visible. Incentives are working. Farmers are digitised. Tax structures are

cleaner. Skills are scaling. And the narrative has shifted from survival to

leadership.

If

2025 was the year of groundwork, 2026 could well be the year India’s textile

ambition begins to show its full global weight.

The Ministry of Textiles’ 2025 year-end review reads less like a government scorecard and more like a blueprint for the next decade. From mega textile parks to fibre reforms, from GST rationalisation to export resilience, the direction is clear - India wants to be a predictable, competitive and future-ready textile powerhouse. Looking ahead, the Ministry’s Vision 2030 target of US$ 100 billion in exports signals intent. The strategy is clear: market diversification, sustainability-led differentiation and deeper district-level export mapping - already completed across 520 districts.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.