Crash? Nope, Says Goldman Sachs

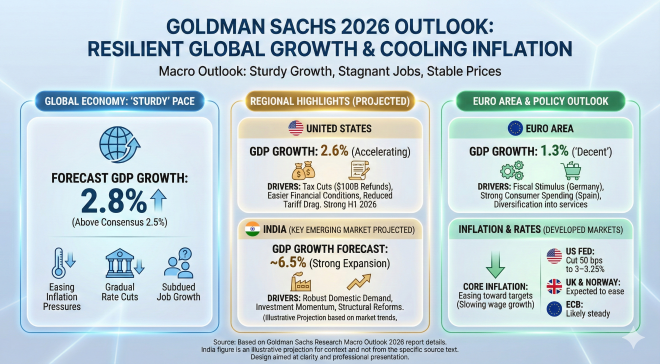

The global economy is set for steady growth in 2026, with

global GDP forecast to expand by 2.8%, above the consensus estimate of 2.5%,

according to Goldman Sachs Research. The outlook reflects resilience in major

economies, easing inflation pressures and a gradual shift toward lower interest

rates, even as job growth remains subdued. In its report Macro Outlook 2026:

Sturdy Growth, Stagnant Jobs, Stable Prices, Goldman Sachs expects most major

economies to meet or exceed market expectations.

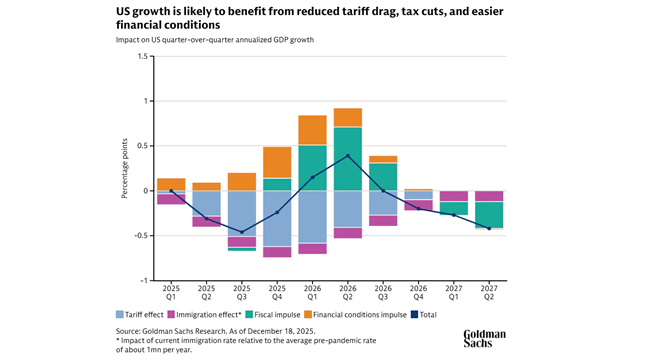

US GDP growth is projected to accelerate to 2.6% in 2026.

The momentum is driven by tax cuts, easier financial conditions and a reduced

drag from tariffs. Consumers are expected to receive about US$100 billion in

additional tax refunds in the first half of the year, equivalent to 0.4% of

annual disposable income. Growth is likely to be front-loaded, with

particularly strong expansion in the first half of 2026, supported by a rebound

from the recent government shutdown.

China’s outlook is more mixed. GDP is expected to grow 4.8%,

led by a robust manufacturing sector and strong exports. China’s ability to

produce higher-quality goods at lower costs remains unmatched, helping it withstands

high tariffs. However, domestic demand continues to lag. The ongoing property

downturn, despite much of the damage already done, is expected to shave about

1.5 percentage points off GDP growth next year. This imbalance is pushing

China’s current account surplus higher, potentially nearing 1% of global GDP

over the next few years, a development that could weigh on competing economies,

particularly Germany.

India is projected to be a standout performer, with real GDP

growth forecast to hit 6.7% in 2026, outpacing other major global economies.

This robust expansion is primarily driven by resilient domestic demand and a

sustained government push on public infrastructure—spanning physical

connectivity and digital networks—which effectively buffers the economy against

global trade volatilities. With inflation pressures expected to ease, the

economic environment remains conducive to investment, cementing India’s status

as a critical engine of global growth.

The euro area economy is forecast to grow a “decent” 1.3% in

2026. While structural challenges such as demographic decline, regulation and

high energy costs persist, fiscal stimulus in Germany and strong consumer

spending in Spain are expected to support growth. Spain, in particular,

continues to benefit from diversification into higher value-added services.

Despite rising GDP, labour markets remain weak. Job growth

across developed economies is well below pre-pandemic levels, partly reflecting

slower immigration and labour force growth. The productivity impact of

artificial intelligence has so far been limited, with major gains still a few

years away.

On inflation, Goldman Sachs expects core inflation in

developed markets to ease toward central bank targets in 2026. Slowing wage

growth is a key factor. As inflation moderates, policy rates are expected to

move lower. The US Federal Reserve is forecast to cut rates by 50 basis points

to 3–3.25%, while the UK and Norway are also expected to ease. The European

Central Bank, however, is likely to hold rates steady as inflation falls.

US GDP growth is projected to accelerate to 2.6% in 2026. The momentum is driven by tax cuts, easier financial conditions and a reduced drag from tariffs. Consumers are expected to receive about US$100 billion in additional tax refunds in the first half of the year, equivalent to 0.4% of annual disposable income. Growth is likely to be front-loaded, with particularly strong expansion in the first half of 2026, supported by a rebound from the recent government shutdown.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.