India Loses Ground As U.S. Textile & Apparel Imports From Vietnam Surge, China Crashes

US imports of textiles and apparel from

India plunged 31.4% year-on-year in November 2025, compared with November 2024,

one of the steepest monthly declines among major sourcing nations, highlighting

the mounting strain on Indian exporters in the U.S. market.

The divergence with rival suppliers was

stark. While India faltered, U.S. textile and apparel imports from Vietnam

surged 12.2% year-on-year in November, reinforcing Vietnam’s accelerating

dominance as a preferred sourcing hub. Bangladesh, by contrast, saw imports

fall 14.5% during the same month, pointing to continued pressure on South Asian

suppliers.

Looking beyond November, Vietnam’s momentum

stood out even more clearly. Throughout 2025, the country delivered consistent

double-digit growth, with strong gains recorded in April, May, and June.

China, meanwhile, remained in deep

contraction mode, with imports declining across most months of 2025 and

plunging a dramatic 48.5% in November alone.

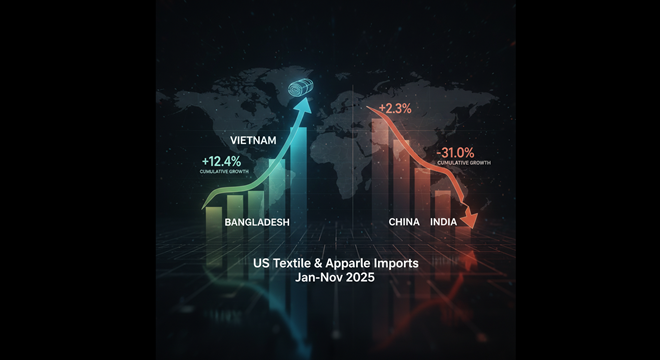

On a cumulative basis from January to

November 2025, the contrasts were equally pronounced. U.S. imports from Vietnam

rose 12.4%, while imports from China slumped 31.0%. India managed only a

marginal 2.3% increase over the period, lagging well behind peers, whereas

Bangladesh posted an overall growth of 12.1% despite its sharp November

decline, the data showed.

The divergence with rival suppliers was stark. While India faltered, U.S. textile and apparel imports from Vietnam surged 12.2% year-on-year in November, reinforcing Vietnam’s accelerating dominance as a preferred sourcing hub. Bangladesh, by contrast, saw imports fall 14.5% during the same month, pointing to continued pressure on South Asian suppliers.

If you wish to Subscribe to Textile Excellence Print Edition, kindly fill in the below form and we shall get back to you with details.